Since October 2024, Wero, the successor to Paylib, has been gradually rolled out. And since March 2025, it has been the single solution for your instant mobile transfers between individuals. We tell you all about this new service that aspires to become essential.

In March 2025, Wero took over from Paylib and will thus become the single solution for your instant payments via smartphones in France and Europe. The Wero system is supported by 16 major European banks united in the European Payments Initiative (EPI). The objective of this pan-European service? To offer a European "sovereign" payment solution to reduce dependence on American giants.

This change is part of a context of European harmonization regarding instant bank transfers. Indeed, since January 9, 2025, their reception has been made mandatory free for all banks in the eurozone. For their issuance, they have until October 9, 2025 to implement the function.

Read also – Victim of a banking scam? Be careful, your bank will not necessarily reimburse you

Wero: a free, fast, practical and secure service

Paylib will disappear in a few weeks and if you were one of the 35 million registered, your bank may have already offered you to switch to Wero. Paylib is dead, long live Wero! But what is the difference between these two services? None... almost. And because good accounts make good friends, with Wero you can continue to send and receive money instantly.

Wero makes payments between individuals easier: no longer need an IBAN to make transfers via smartphones, with a phone number or an email address you can make up to €500/day, at any time of the day or night, in real time.

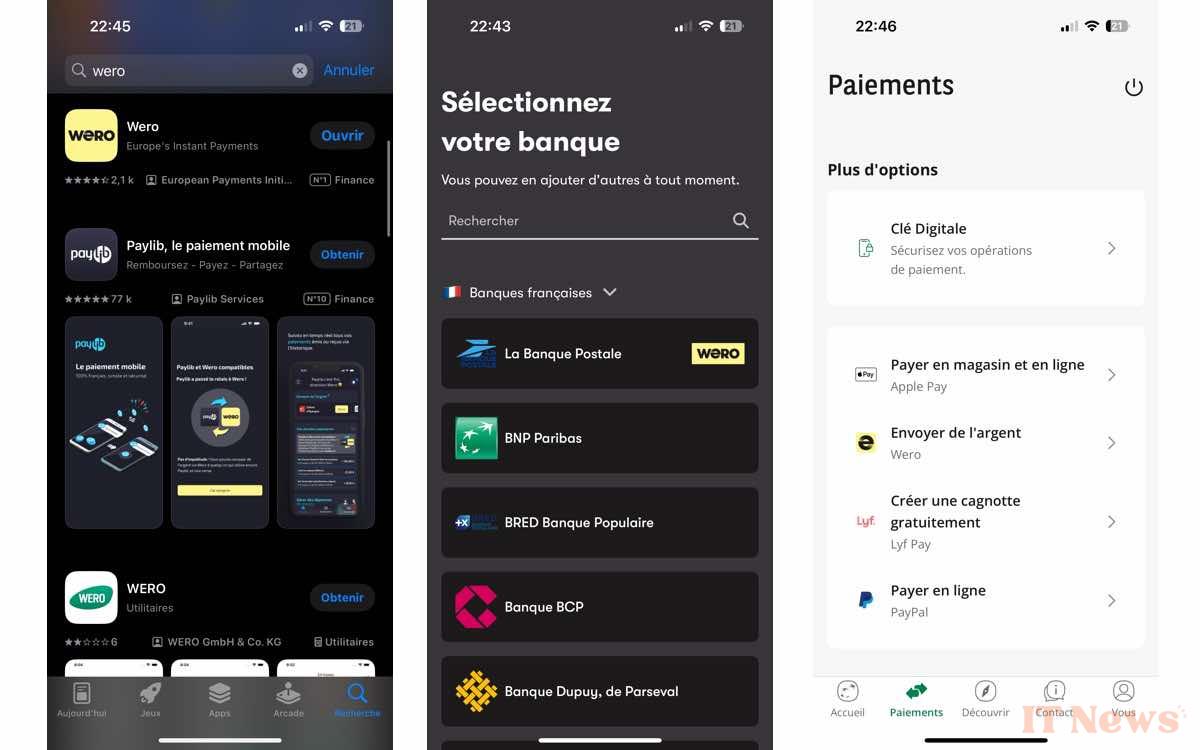

And if Wero is directly accessible in your banking application via a dedicated tab, with the exception of La Banque Postale (LBP) for which you will have to use the Wero app while waiting for an overhaul of the LBP app. In total, nearly 20 banks and their subsidiaries have implemented Wero:

- La Banque Postale, via the Wero application

- BNP Paribas

- BRED Banque Populaire

- BCP Bank

- Banque Dupuy, de Parseval

- Banque Marze

- Banque Palatine

- Banque Populaire

- Banque de Savoie

- CIC

- Caisse d’Épargne

- Crédit Agricole

- Crédit Coopératif

- Crédit Maritime

- Crédit Mutuel

- Crédit Mutuel Arkéa

- Hello bank! France

- LCL

- Monabanq

- Société Générale

Since the security of your banking data is a priority, Wero works directly with your bank without ever going through an intermediary. That's why, if you use Wero via your banking app and encounter a problem, your bank's customer service will answer your questions.

And if your contact is still with Paylib? Don't panic! During the transition period, payments between Paylib and Wero users are still possible.

How does Wero work?

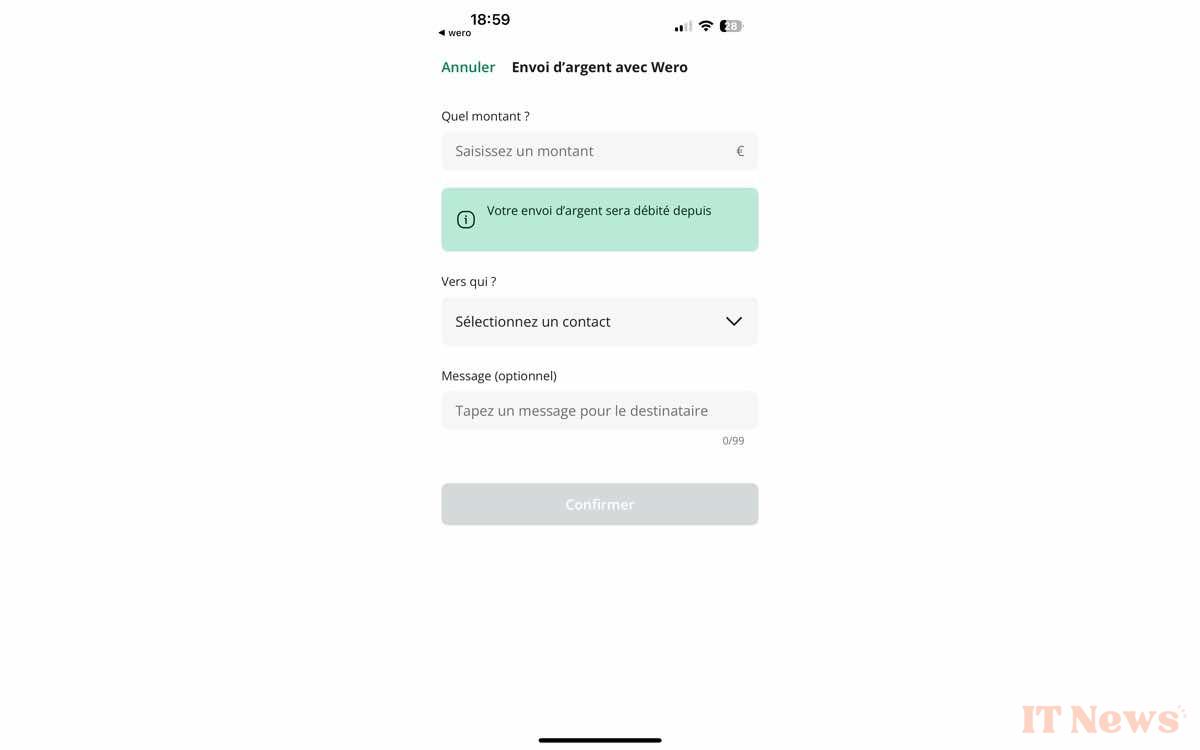

- Download the appon iOS or Android or find Wero in your banking app

- Choose the bank accountwith which you want to pay

- Enter the contactto whom you want to send money: either by selecting them from your contacts, or by entering their number or email address

- Enter the amountto send

- Write a personalized message

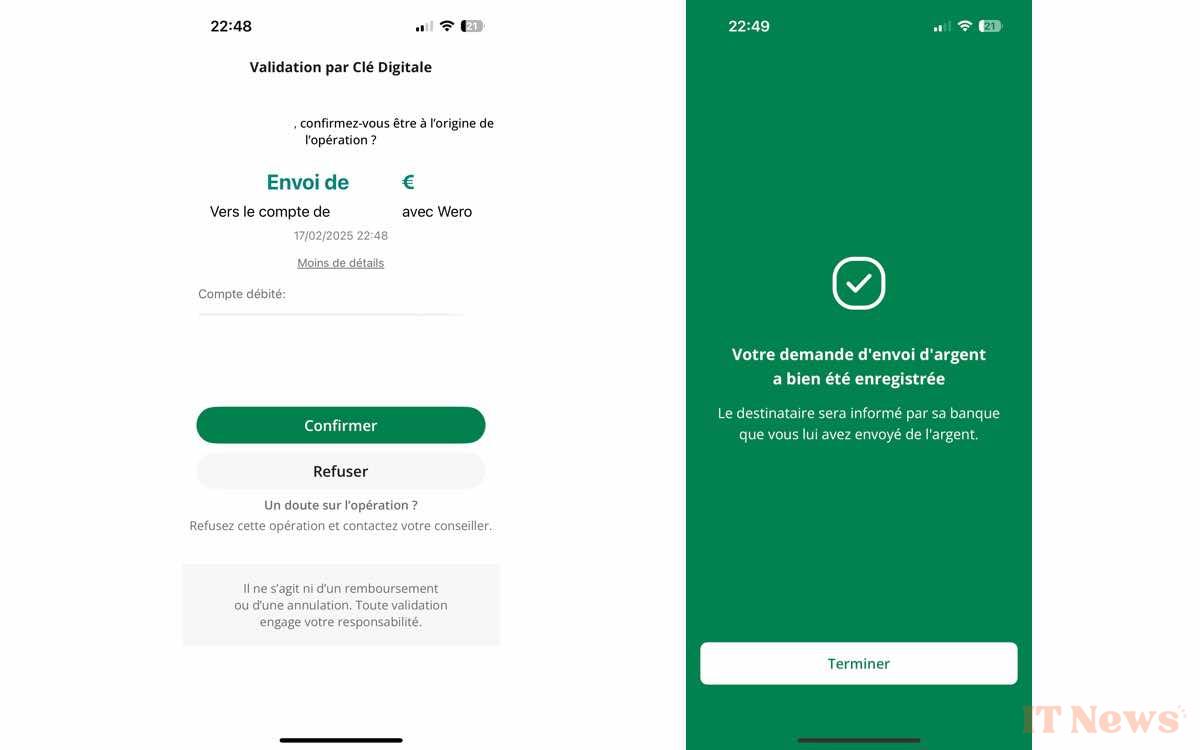

- Validate. You will be asked to use a strong authentication device…

- And in less than 10 seconds, your contact has received your money!

Here are the upcoming new features promised by Wero

If Paylib has helped democratize digital payments made in France; Wero, while following in its footsteps, promises to go even further. It aims to deploy its services throughout Europe: after Germany, France, and Belgium, the Netherlands is expected to follow in 2025. Features such as "Request Money" or the generation of individual QR codes so you don't have to provide your phone number are expected to be integrated.

Wero also aims to become a unique mobile payment wallet by going beyond person-to-person service. It plans to eventually enable payments at small merchants, at the points of sale of large merchants, online on merchant sites, and subscription management. Other services are also in the pipeline, including installment payments (or Buy Now-Pay Later), integration with merchant loyalty programs, and expense sharing.

Wero, towards a mobile payment revolution?

With all these promises of upcoming features, the service aims to become the new, essential single digital wallet in Europe within 3 to 4 years, competing with Apple Cards in particular.

But to establish itself as the benchmark for instant mobile payment, Wero will have to prove itself against its American (PayPal, Apple Pay, etc.) and European competitors. Bizum, its Spanish counterpart, had 10 million more users than Wero last December and joined forces with Italian and Portuguese services to form "EuroPa."

0 Comments